Insurance In Toccoa Ga Things To Know Before You Get This

Table of Contents7 Simple Techniques For Commercial Insurance In Toccoa GaRumored Buzz on Annuities In Toccoa GaA Biased View of Life Insurance In Toccoa GaHow Automobile Insurance In Toccoa Ga can Save You Time, Stress, and Money.

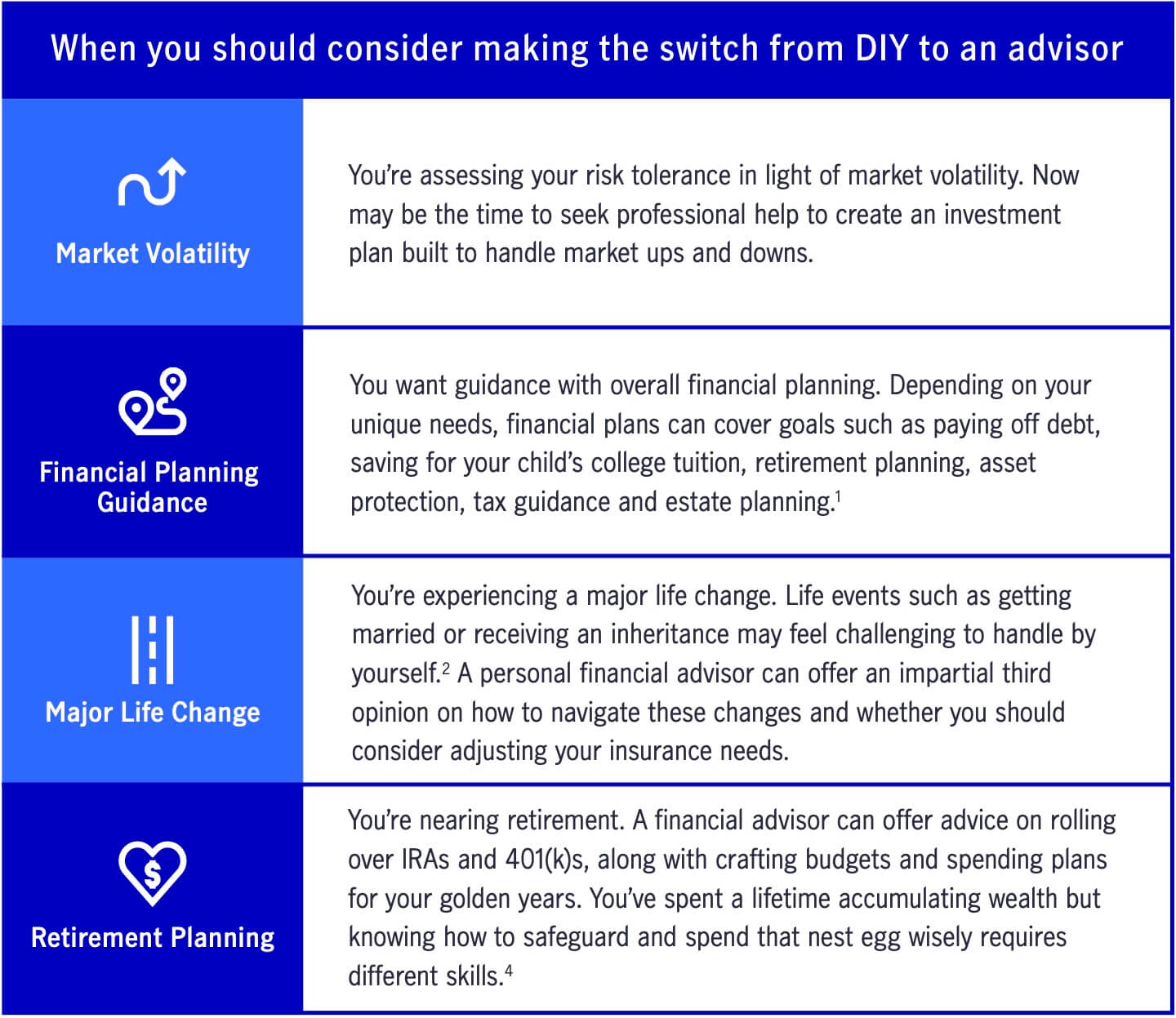

An economic consultant can additionally help you choose just how finest to achieve objectives like saving for your youngster's university education or paying off your financial obligation. Although financial consultants are not as skilled in tax obligation law as an accountant may be, they can offer some assistance in the tax obligation preparation process.Some financial consultants use estate preparation services to their customers. It's vital for economic consultants to remain up to date with the market, financial conditions and advising best techniques.

To market investment products, experts must pass the appropriate Financial Industry Regulatory Authority-administered examinations such as the SIE or Series 6 examinations to get their qualification. Advisors that want to market annuities or other insurance policy products need to have a state insurance policy certificate in the state in which they plan to market them.

Little Known Questions About Final Expense In Toccoa Ga.

Let's claim you have $5 million in possessions to manage. You hire an expert that bills you 0. 50% of AUM per year to benefit you. This implies that the consultant will get $25,000 a year in fees for handling your investments. Due to the fact that of the regular fee structure, several experts will certainly not collaborate with customers who have under $1 million in possessions to be handled.

Financiers with smaller profiles might seek an economic consultant that bills a per hour charge rather than a percent of AUM. Per hour charges for experts normally run between $200 and $400 an hour. The even more facility your monetary circumstance is, the even more time your expert will have to devote to managing your properties, making it extra costly.

Advisors are competent experts who can assist you develop a prepare for financial success and execute it. You might also take into consideration getting to out to a consultant if your individual monetary scenarios have actually lately come to be more difficult. This might imply getting a house, marrying, having children or obtaining a big inheritance.

%20fee%20(1).png)

Fascination About Life Insurance In Toccoa Ga

Before you meet with the advisor for a first examination, consider what services are most vital to you. You'll desire to look for out a consultant who has experience with the services you desire.

For how long have you been recommending? What business were you in prior to you got involved in monetary recommending? Who composes your common customer base? Can you give me with names of a few of your customers so I can review your services with them? Will I be dealing with you straight or with an associate advisor? You might also intend to take a look at some sample monetary strategies from the advisor.

If all the examples you're supplied are the exact same or comparable, it may be an indication that this consultant does not properly customize their advice for every client. There are 3 major types of economic advising experts: Qualified Financial Coordinator experts, Chartered Financial Experts and Personal Financial Specialists - https://www.webtoolhub.com/profile.aspx?user=42362864. The Qualified Financial Organizer specialist (CFP specialist) certification shows that an advisor has actually fulfilled a specialist and moral standard established by the CFP Board

About Automobile Insurance In Toccoa Ga

When selecting a monetary advisor, consider someone with a specialist credential like a CFP or CFA - https://yoomark.com/content/thomas-insurance-advisors-located-toccoa-ga-and-toccoas-leading-insurance-agency-serving. You could additionally consider an advisor who has experience in the services that are most important to you

These experts are generally filled with website link disputes of interest they're much more salesmen than consultants. That's why it's important that you have an advisor who functions only in your benefit. If you're seeking a consultant who can absolutely offer genuine value to you, it is very important to look into a variety of prospective options, not simply choose the very first name that advertises to you.

Presently, numerous experts have to act in your "best rate of interest," yet what that entails can be nearly void, except in the most egregious instances. You'll need to find a real fiduciary.

"They need to verify it to you by showing they have actually taken major ongoing training in retirement tax and estate planning," he states. "You must not invest with any type of advisor that does not spend in their education.